HISTORY

Intensive development of receivables management market in the years 2012-2018 resulted qualification of Polish market as mature. One of the results of that qualification was entering to the market of recognized entities operating in the debt management industry.

Increasing competition between Polish and international entities was one of the reasons of the crisis of the industry. Financial problems of one of the leading management companies in debts at the beginning of 2018 was the starting point of the crisis. Problems of one of the industry leaders spread throughout the market resulting in a significant decrease in the number and value of transactions due to the limited access to financing for local entities, and expectations to reduce the level of prices for debt portfolios offered by the sellers of debt portfolios.

Basic business model has changed where more and more entities due to lack of investment capital turned towards the commissioned services to financial investors interested in portfolios of receivables. Currently, the market slowly begins to rebuild, resulting in, among others, observed increased interest in entering the Polish market by entities, which have so far been absent in it.

CURRENT SITUATION

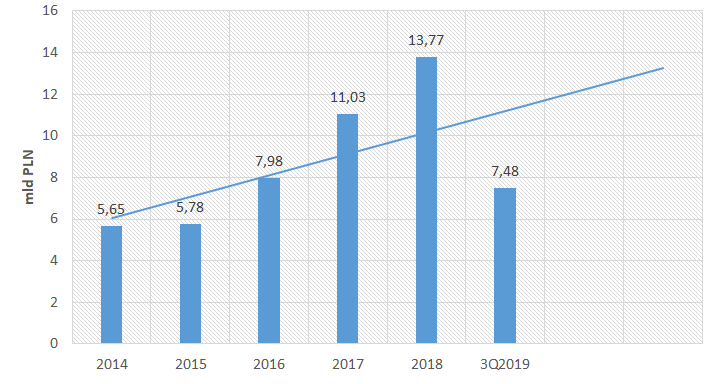

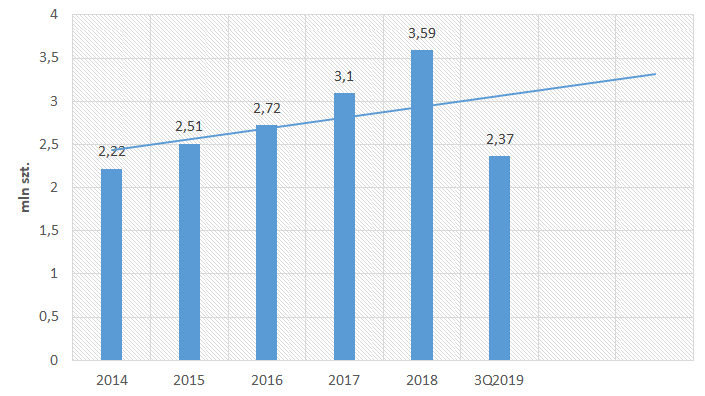

Debt market in Poland is characterized by a systematic and stable growth in the volume of debt available both on the primary and secondary markets.

Mentioned above lack of funding opportunities for the business operators in the NPL in Poland, in turn, results in a significant advantage of the supply of debt portfolios on the possibilities of demand-side management companies. There is a growing volume of debts that cannot find their buyers, and this results in a significant drop in prices offered for receivables, both at auctions organized by the original creditors, as well as on the secondary market.

OUTLOOK

What is bothering some, for others it is a business opportunity. It makes a chance to benefit for entities having adequate access to financing, mainly international investment funds and asset management companies. One of the biggest challenges for investors interested in acquiring portfolios of receivables (PL or NPL) in Poland, is the lack of their own structures on the Polish market, which not only oversee the investment process, but most of all current operations.